Panduan Bermain Slot Online: Strategi Gacor Demo x1000 Terbaik

Selamat datang di dunia seru dan mengasyikkan dari permainan slot online! Bagi para pecinta judi online, slot telah menjadi salah satu permainan terpopuler dan paling dinikmati dalam industri kasino berbasis web. Dengan beragam tema, fitur menarik, dan kesempatan untuk mendapatkan kemenangan besar, tidak heran jika slot online terus memikat banyak pemain untuk ikut merasakan sensasinya.

Salah satu kunci sukses dalam bermain slot online adalah memahami strategi terbaik untuk mencapai kemenangan maksimal. Dalam artikel ini, kita akan membahas panduan lengkap tentang cara bermain slot online dengan strategi "gacor" demo hingga x1000. Mulai dari memahami demo slot, hingga memanfaatkan fitur demo slot x500 dan x1000, serta eksplorasi tentang slot pragmatic play dan slot pgsoft, semuanya akan dibahas secara mendalam agar Anda bisa meraih kesuksesan dalam dunia judi slot online.

Strategi Bermain Slot Online X1000

Pertama, penting untuk memahami aturan dan mekanisme permainan slot online. Pastikan untuk memahami pola pembayaran, simbol yang penting, dan fitur bonus yang ada. Dengan pemahaman ini, Anda dapat membuat keputusan yang lebih cerdas saat bermain.

Kedua, atur modal dengan bijak dan tetap disiplin dalam pengelolaan uang. Tetapkan batasan kerugian dan kemenangan sebelum mulai bermain. Jangan tergoda untuk terus bermain saat sudah melampaui batasan yang ditetapkan.

Terakhir, manfaatkan kesempatan untuk mencoba versi demo sebelum memasang taruhan dengan uang sungguhan. Dengan berlatih di demo slot x1000, Anda dapat mengasah keterampilan, menguji strategi, dan mengenali pola permainan tanpa risiko kehilangan uang.

Daftar Provider Slot Terbaik

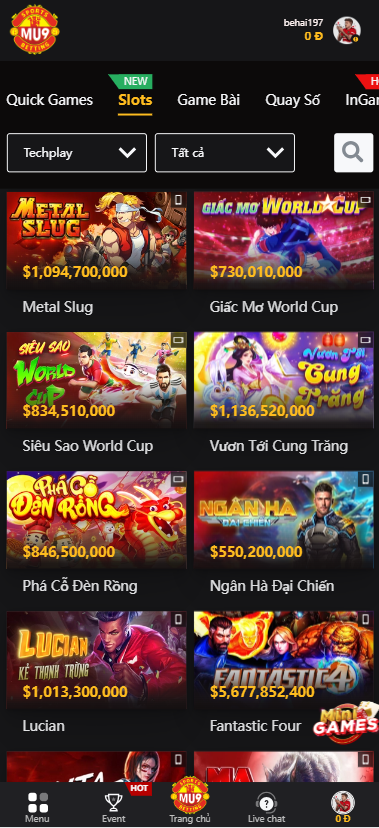

Pada dunia slot online, terdapat berbagai provider ternama yang menawarkan pengalaman bermain yang menarik. Salah satu provider yang sangat populer adalah Pragmatic Play, yang dikenal dengan koleksi slotnya yang menarik dan beragam fitur bonus. Selain itu, PGSoft juga termasuk dalam daftar provider terbaik dengan desain grafis yang menarik dan gameplay yang inovatif.

Tidak hanya itu, terdapat juga provider lain yang patut diperhitungkan dalam dunia judi slot online, yaitu Play’n GO. Dikenal dengan slotnya yang kreatif dan tema yang beragam, Play’n GO menjadi pilihan yang sangat menarik bagi para pemain slot. Dengan fitur bonus yang sering kali menggiurkan, Play’n GO berhasil menarik perhatian para pecinta slot online.

Selain itu, tidak boleh dilupakan provider lain seperti NetEnt yang telah lama menjadi ikon dalam industri permainan kasino online. Dengan kualitas grafis yang tinggi dan desain yang menawan, slot NetEnt selalu menawarkan pengalaman bermain yang memikat. Dengan hadirnya berbagai fitur inovatif, NetEnt menjadi salah satu provider slot terbaik yang layak untuk dicoba.

Tips Bermain Slot Gratis

Bagi para pemain yang ingin menikmati pengalaman bermain slot gratis, ada beberapa tips yang dapat membantu meningkatkan peluang menang. Pertama, pastikan untuk memanfaatkan bonus dan promosi yang disediakan oleh situs judi slot online. Dengan memanfaatkan bonus tersebut, Anda dapat bermain lebih lama tanpa perlu mengeluarkan uang.

Selain itu, penting juga untuk memilih mesin slot yang sesuai dengan preferensi dan gaya bermain Anda. Ada berbagai variasi slot online gratis yang tersedia, jadi pilihlah yang sesuai dengan selera Anda. Jika lebih suka dengan tema slot tertentu, carilah mesin yang memiliki tema tersebut untuk meningkatkan kesenangan bermain.

Terakhir, jangan lupa untuk tetap disiplin dalam pengelolaan uang Anda saat bermain slot gratis. Tetapkan batas jumlah taruhan yang ingin Anda lakukan dan patuhi batasan tersebut. Dengan mengikuti tips ini, Anda dapat menikmati permainan slot online gratis dengan lebih baik dan mengoptimalkan kesempatan untuk meraih kemenangan.